As of January 29, 2025, BlackRock net worth stood at $163.03 billion, reflecting a 38.26% growth compared to the previous year.

BlackRock is one of the world’s leading asset managers, overseeing an extraordinary $11.5 trillion in assets as of 2024. What began as a risk management and fixed-income firm in 1988 has evolved into a global financial powerhouse, operating across 70 offices in 30 countries.

The company’s influence extends far beyond traditional asset management. Through its iShares division, BlackRock has become one of the “Big Three” index fund managers alongside Vanguard and State Street. Its proprietary Aladdin software platform serves as the technological backbone for numerous major financial institutions, offering sophisticated risk management capabilities.

BlackRock’s approach to environmental, social, and governance (ESG) investing has placed it at the center of contemporary financial debates. While positioning itself as an ESG leader, the company has faced both support and pushback – several U.S. states have withdrawn investments due to its ESG policies, while others have criticized its investments in controversial sectors and its relationship with the Federal Reserve during the COVID-19 crisis.

The company’s reach and influence have made it a significant force in global finance, ranking 229th on the Fortune 500 list. This position highlights how BlackRock has transformed from a specialized risk manager into an institution that shapes modern investment practices and financial markets.

Contents

Blackrock Net Worth

As of January 29, 2025, BlackRock, the world’s largest asset management firm, reported a net worth of $163.03 billion. This marks an impressive 38.26% increase from the previous year, showcasing the firm’s strong financial performance and strategic market positioning.

SEE ALSO: Ritesh Agarwal Net Worth: Wiki, Age, Family, Wife, & Career

Who Owns Blackrock?

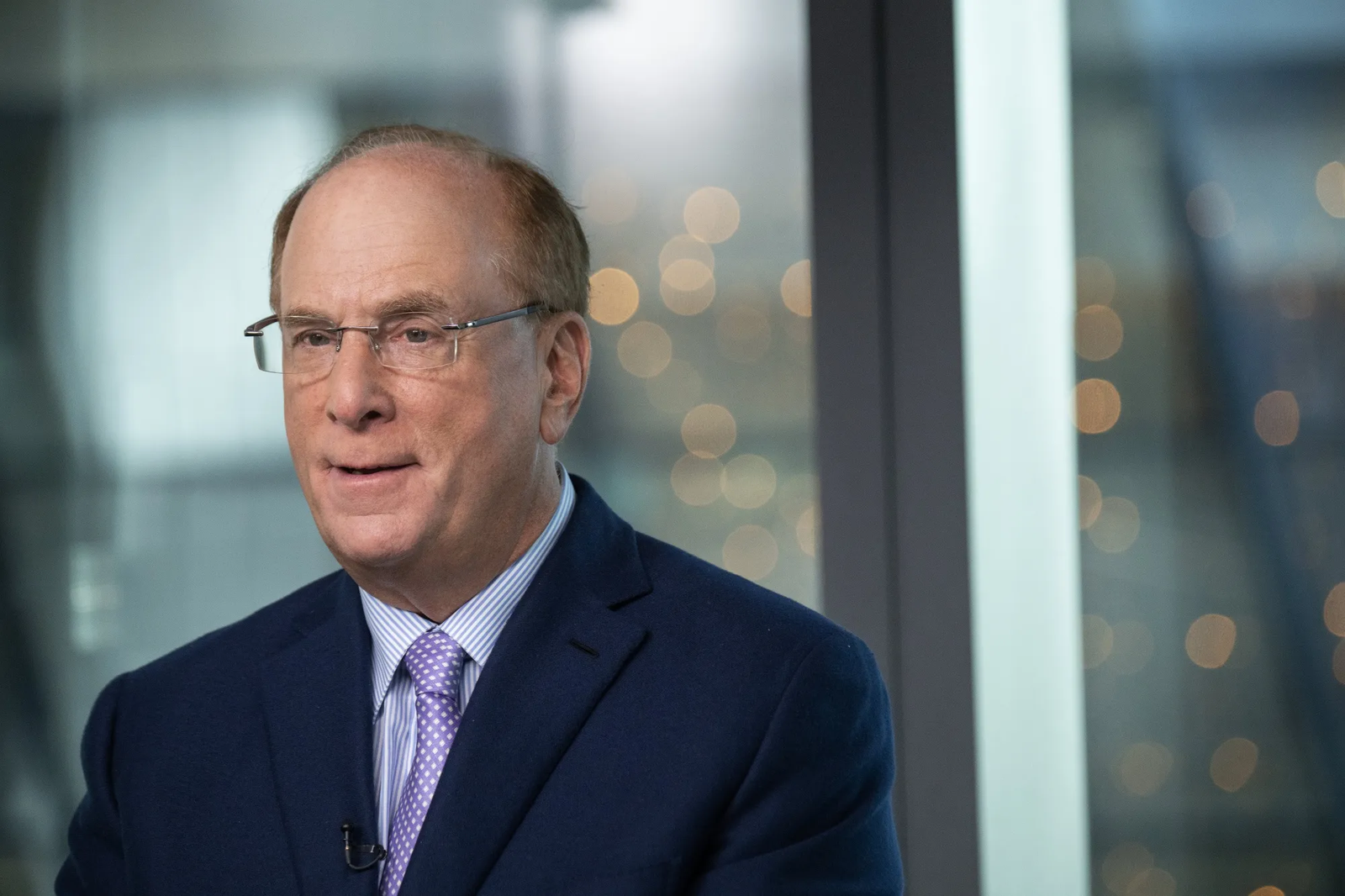

Laurence D. Fink is the Chairman and Chief Executive Officer of BlackRock, a company he co-founded in 1988 with seven partners. Under his leadership, BlackRock has become a global leader in investment and technology solutions, managing more assets than any other investment firm worldwide. The firm’s mission is to help clients build better financial futures.

Before founding BlackRock, Mr. Fink was a Managing Director and a member of the Management Committee at The First Boston Corporation.

Mr. Fink holds several notable positions. He is a member of the Board of Trustees of the World Economic Forum and Co-Chair of the NYU Langone Medical Center Board of Trustees. He also serves on the boards of the Museum of Modern Art and the International Rescue Committee. Additionally, he is a member of the Advisory Board of the Tsinghua University School of Economics and Management in Beijing and the Executive Committee of the Partnership for New York City.

Mr. Fink earned both his MBA (1976) and BA (1974) from the University of California, Los Angeles (UCLA).

SEE ALSO: Jaanmoni Das Net Worth: Age, Marriage, Birthday, & Old Photos

BlackRock History

BlackRock’s story began in 1988 when Larry Fink and seven other co-founders established the company to provide institutional clients with asset management services focused on risk management. The founders, including Fink, Robert Kapito, Susan Wagner, and Barbara Novick, had previously worked at First Boston, where they pioneered mortgage-backed securities.

Initially backed by The Blackstone Group with a $5 million credit line for a 50% stake, the firm quickly turned profitable. By 1992, BlackRock was managing $17 billion in assets. A pivotal moment came in 1994 when the company separated from Blackstone following disagreements between Fink and Stephen Schwarzman over compensation and equity sharing.

BlackRock went public in 1999, and through the 2000s, made several strategic acquisitions, including State Street Research & Management and Merrill Lynch’s Investment Managers division. The 2008 financial crisis proved significant for BlackRock, as the U.S. Treasury Department sought their expertise to manage toxic assets.

The company’s growth continued with the landmark acquisition of Barclays Global Investors in 2010, which included the iShares ETF business. By 2014, BlackRock had become the world’s largest asset manager. Recent years have seen the company expand into digital wealth management, enter the Chinese market, and launch cryptocurrency ETFs. Notable developments include their involvement in Ukraine’s reconstruction efforts and the 2024 acquisition of Global Infrastructure Partners for $12.5 billion.

As of 2024, BlackRock manages over $11.5 trillion in assets, solidifying its position as the world’s leading asset management firm.

Ownership Structure of BlackRock as of 2024

BlackRock, one of the world’s largest asset management firms, has a diverse ownership structure dominated by institutional investors. Over 80% of BlackRock’s shares are held by such entities, reflecting the company’s significant appeal among large financial organizations and investment institutions.

Changes in Ownership

In March 2018, PNC Financial Services was BlackRock’s largest shareholder, owning 25% of the company. However, in May 2020, PNC announced its intention to sell all its shares in BlackRock, worth approximately $17 billion, marking a notable shift in the firm’s ownership dynamics.

SEE ALSO: Khaby Lame Net Worth: Wife, Wikipedia, Instagram, Reddit, & Bio

As of June 30, 2024, the top 10 shareholders of BlackRock accounted for 36.07% of the company’s total shares. Here’s a breakdown of the largest shareholders:

| Shareholder | Country | Shares | % Ownership |

|---|---|---|---|

| The Vanguard Group | United States | 13,215,837 | 9.08% |

| BlackRock Inc. | United States | 9,515,504 | 7.02% |

| State Street Corporation | United States | 5,940,826 | 4.95% |

| Temasek Holdings Ltd. | Singapore | 5,133,360 | 4.28% |

| Bank of America Corp. | United States | 5,133,311 | 4.28% |

| Capital Research Global Investors | United States | 4,532,590 | 3.78% |

| Morgan Stanley | United States | 4,342,978 | 3.62% |

| Charles Schwab Corporation | United States | 3,768,467 | 3.14% |

| Capital World Investors | United States | 3,218,145 | 2.68% |

| Geode Capital Management | United States | 2,786,395 | 2.32% |

Total Ownership

The combined shares of the top 10 shareholders amounted to 44,371,576, which represents 36.07% of BlackRock’s total shares. The company has a total of 120,006,939 outstanding shares as of the same date.

Issues Surrounding BlackRock

Influence and Power

BlackRock’s immense size and influence have earned it the label of the world’s largest “shadow bank” by publications like The Economist and Basler Zeitung. This designation stems from the company’s ability to operate as a significant financial entity without being regulated like traditional banks.

In 2020, U.S. Representatives Katie Porter and Jesús “Chuy” García introduced a bill in the House of Representatives aimed at curbing the influence of BlackRock and similar shadow banks. Further highlighting the concerns surrounding BlackRock’s power, Senator Elizabeth Warren suggested on March 4, 2021, that the firm should be designated as “too big to fail,” which would subject it to stricter regulations.

SEE ALSO: Sharelle Rosado Net Worth: Age, Career, Education, Family, & Bio

Corporate Influence

BlackRock manages investments for its clients, including owners of iShares exchange-traded funds, by investing in a wide array of publicly traded companies. This often places BlackRock among the largest shareholders of competing firms. While BlackRock maintains that these shares are owned by its clients rather than the firm itself, it acknowledges its authority to cast shareholder votes on their behalf—frequently without direct input from clients. This dual role as a major investor and proxy voter has sparked debates about its influence in corporate governance.

Misinformation and Conspiracy Theories

Due to its prominence, BlackRock has been the target of several conspiracy theories:

- Claims that BlackRock owns both Fox News and Dominion Voting Systems have been debunked. Fact-checkers like Snopes labeled these claims as “false,” while PolitiFact described them as “mostly false.”

- Some conspiracy theories have incorporated antisemitic narratives, alleging that BlackRock’s leadership, including founder Robert Kapito, is part of a Jewish cabal responsible for orchestrating COVID-19 or advancing a so-called “COVID agenda.” These baseless theories contribute to harmful misinformation and bigotry.

BlackRock’s scale and operations have drawn significant scrutiny from regulators, politicians, and the public, making it a focal point for discussions about corporate power, regulatory oversight, and the spread of misinformation.

Common Ownership

Common ownership occurs when competitors in a market share the same influential shareholders, typically because their publicly traded shares are held by the same investors. This phenomenon can potentially harm market dynamics by reducing competition, which negatively impacts consumers and the broader economy.

In response to a widely cited research paper that argued common ownership leads to higher prices, BlackRock published a white paper dismissing the mechanism as “vague and implausible.” However, the findings of the research were still listed as a “risk” in BlackRock’s annual report. Additionally, common ownership has been associated with higher CEO compensation, even as it diminishes competition among firms.

SEE ALSO: Nadiya Hussain Net Worth: Family, Husband, Children, & Salary

Blackrock Key People

As of 2024, BlackRock’s board of directors consists of 17 members, including the following notable individuals:

- Larry Fink – Founder, Chairman, and CEO

- William E. Ford

- Fabrizio Freda

- Margaret “Peggy” L. Johnson

- Robert S. Kapito – Founder and Co-President

- Cheryl D. Mills

- Amin H. Nasser

- Gordon M. Nixon

- Charles H. Robbins

- Hans V. Vestberg

- Susan Wagner – Founder and Board Member

- Mark Wilson

Former board members include:

- Brian Deese – Former Global Head of Sustainable Investing

- Blake Grossman – Former Vice Chairman

Conclusion on Blackrock Net Worth

BlackRock’s net worth, standing at $163.03 billion as of January 29, 2025, reflects not only its robust financial performance but also its unparalleled influence in the global financial landscape. Overseeing $11.5 trillion in assets, BlackRock has cemented its position as the world’s largest asset manager, transforming from a modest risk management firm in 1988 to a financial giant operating across 70 offices in 30 countries.

The firm’s journey is marked by key milestones, such as the landmark acquisition of Barclays Global Investors, the development of its Aladdin technology platform, and its dominance in the ETF market through iShares. However, its role as a leader in ESG investing and its extensive corporate influence have sparked debates, regulatory scrutiny, and occasional backlash, underscoring its complex role in modern finance.

From being labeled a “shadow bank” to facing conspiracy theories and concerns over common ownership, BlackRock’s size and scope have drawn both admiration and criticism. Yet, its adaptability and strategic innovations continue to solidify its standing. The firm’s ownership structure, with significant stakes held by institutional investors like Vanguard and State Street, highlights its appeal to major financial entities.

Mariam Sulaimon is a versatile content writer, critical thinker, and researcher passionate about public relations. She crafts compelling SEO articles across diverse niches, including technical, health, and job articles. Her versatility allows her to adapt her writing style to different audiences while maintaining clarity and engagement.

Leave a Reply